OWNER RELATIONS

Address:

Owner Relations

811 Gilmer Rd.

Longview, TX 75604

Phone: 903-759-8822

Fax: 903-759-2153

Email: ownerrelations@cwresources.com

All forms require Adobe PDF Reader  to open, get it here!

to open, get it here!

Address Change

Change of Address FormThis form must be submitted via email, fax or mailed. Please do not call this information in.

Name Change

Corporate or Company name changes should provide the Certificate of Name Change/Merger as well as a new W-9.

Individuals must provide a written request. Requests should include your old name as it currently appears in our records, your new name, and you MUST include a court certified copy of the name change, marriage certificate or divorce decree. In the event your divorce is not yet finalized, you should state whether you want your payments to continue under your old name or whether you want your payments suspended until the divorce proceedings are complete.

Power of Attorney – Please provide certified designation document.

Ownership Changes

Sale of Interest : Please provide the Title Instrument(s) filed of record in the county where the property and/or minerals are located.

Transfers : Please provide certified recorded copies of any Quit Claim, Gift Deeds and Transfer on Death Deeds.

Trust/Partnership Change:

Trustee change – Please provide us with a copy of that portion of the trust instrument that identifies the successor trustee, its duties and powers, and the circumstances leading to the trustee’s replacement. You should also provide us with the successor trustee’s address.

- Change in Trustee – provide recorded title instrument appointing successor trustee

- Dissolution of Trust or Partnership – provide beneficiary documentation

- Non-residuary Trust or Partnership Agreement – provide title instrument conveying interest to Trust or Partnership

Estate Requirements

If you would like for us to pay the estate until it is closed, please provide the following:

-

- Copy of the Death Certificate

- Copy of the Letters Testamentary or Letters of Administration

If the deceased died testate (LEAVING A WILL THAT WILL BE PUT THROUGH PROBATE), when the estate is settled, please provide copies of the following:

-

- Last Will & Testament

- Final Order admitting Will to Probate or Muniment of Title

- Federal Estate Tax settlement letters and State inheritance receipts or a letter from the executor or the attorney for the estate stating that all inheritance taxes were paid, waived or none were due.

If the deceased died intestate (WITHOUT A WILL OR A WILL THAT WILL NOT BE PUT THROUGH PROBATE), please furnish copies of the following:

-

- Death Certificate

- Affidavit of Heirship; this instrument should be signed by two (2) disinterested persons who are well familiar with the family history of the decedents and not a member of the decedent’s family.

- Order allowing final account and determination of heirs and decree of final distribution, if applicable.

- An affidavit stating all debts and taxes have been paid, waived or none were due.

Affidavit of Heirship Form Estate Requirements Form

All copies of Probate documents as well as the Affidavit of Heirship are required to be recorded of public record in the county in which the wells or interest(s) are located, as referenced above. If I may be of further assistance, please feel free to contact me.

EXECUTORS! In addition to the required Estate paperwork, please include a letter stating the names, addresses, social security numbers (if available), and the corresponding percentage that each heir receives. This helps simplify the allocations to the heirs, and eliminates errors in interpretation of Wills.

Payments

C.W. Resources, Inc. mails royalty revenue on the last business day of every month, and releases royalty checks when your accrued royalties are greater than $100.00 or pays annually, if amounts are greater than $10, whichever occurs first, or as required by applicable state statute.

Direct Deposit – Separate forms are available for Royalty Owners and Working Interest Owners

Royalty Owners EFT Form Working Interest Owners EFT Form

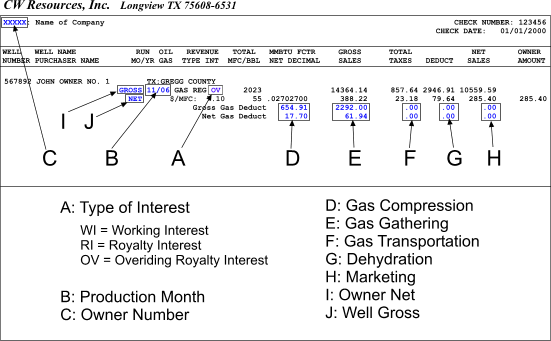

Check Detail